Santa Barbara Essential Local Services Measure (Measure I)

Background

The City of Santa Barbara provides a variety of general municipal services, including fire, police, and emergency 911 medical response; senior and library services; parks maintenance; homelessness response; and other general maintenance and services. In recent years, the City’s ability to maintain these services has become more challenging due to operating costs rising at a faster pace than revenues. Based on current projections, unless a new revenue source is identified, the City faces ongoing budget deficits and service reductions. The Santa Barbara Essential Local Services Measure (Measure I) is a potential option to raise additional revenue to support the City’s General Fund.

Santa Barbara Essential Local Services Measure (Measure I)

The Santa Barbara Essential Local Services Measure (Measure I) is a ballot measure on the November 5th General Municipal Election ballot for City of Santa Barbara voters only. It was referred to the ballot by the Santa Barbara City Council on June 11, 2024.

The Santa Barbara Essential Local Services Measure (Measure I) seeks voter approval to authorize a 1/2 cent sales tax to maintain city services. If approved, Measure I is estimated to generate approximately $15.6 million annually to support Santa Barbara's General Fund.

A “YES vote” approves the City’s proposal; a “NO vote” rejects the proposal.

Santa Barbara Essential Local Services Measure (Measure I) Ballot Question

“Shall the measure maintaining 9-1-1 emergency/fire/paramedic/police response, keeping neighborhood fire stations open; improving housing affordability; addressing homelessness; keeping public areas/parks safe, clean; maintaining library services, stormwater protection; improving natural disaster preparedness; retaining local businesses/jobs, and for general government use; by establishing a ½¢ sales tax providing approximately $15,600,000 annually until ended by voters; requiring audits, public spending disclosure, all funds used locally, be adopted?”

Santa Barbara Essential Local Services Measure (Measure I) Summary

If approved by voters, Measure I will provide additional funding that could be used to:

- Maintain 911 emergency medical, police/crime prevention, and fire response services

- Funding the recently created Local Housing Trust Fund

- Addressing homelessness

- Keeping public areas safe and clean

- Maintaining libraries, parks and recreation programs

And any other services and infrastructure maintained by the General Fund.

Accountability Provisions

- All funds generated by the Santa Barbara Essential Local Services Measure (Measure I) will be for the City of Santa Barbara to provide local general services.

- By law, the State cannot take this funding away, and no funds may be transferred to another agency.

- The City is required to publicly report on the expenditure of revenues.

- All funds are subject to audit and audit results will be reported publicly.

The proposed tax increase would be collected in the same manner as the existing City sales and use tax and would be subject to all the same tax exemptions, such as services, rent, groceries, prescription medicine, utilities, diapers, and feminine hygiene products. For a complete list of all the sales and use tax exemptions, please visit the California Tax Service Center.

What if Measure I doesn’t pass?

If the Santa Barbara Essential Local Services Measure (Measure I) is not approved, the General Fund will not receive the sales tax revenues identified in the Measure. The City Council will then have to decide, as part of the budgeting process, whether other revenues are available to pay for City programs and services, or whether City programs and services will have to be reduced.

Was the Community Consulted prior to Measure I Being Placed on the Ballot?

The City of Santa Barbara hosted a series of 23 outreach and budget presentations between October 2023 and May 2024, and conducted a Community Priorities Survey. At these meetings, staff provided an overview of the City’s services, budget outlook, and the potential option of revenue enhancement. Throughout these outreach initiatives, community members provided input about various priorities and expectations for upcoming years.

The City also distributed a city-wide informational mailer in English and Spanish to educate the public about the specific challenges facing the City and to invite the public to our Community Town Hall events.

Proposed Revenue Measure & Ballot Measure

Finance Committee Meeting

Regular Council Meeting

- June 4, 2024 - Proposed Ballot Measure Presentation (PDF)

- June 4, 2024 - Proposed Ballot Measure Council Agenda Report (PDF)

- June 4, 2024 - Proposed Ballot Measure Presentation Recording

- June 11, 2024 - Proposed Ballot Measure Presentation (PDF)

- June 11, 2024 - Proposed Ballot Measure Council Agenda Report (PDF)

- June 11, 2024 - Proposed Ballot Measure - Ordinance Attachment (PDF)

- June 11, 2024 - Proposed Ballot Measure - Resolution Attachment (PDF)

- June 11, 2024 - Proposed Ballot Measure Presentation Recording

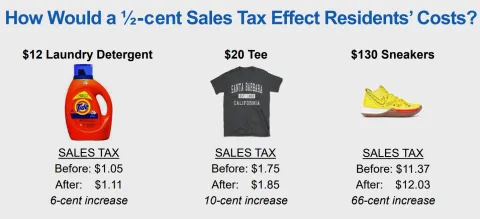

The City is considering a ½-cent sales tax increase ballot measure. The half-cent increase would bring Santa Barbara’s sales tax to 9.25%. The City’s current sales tax is 8.75%. A half-cent sales tax is projected to generate approximately $15.6 Million annually.

Funding from this measure could be used for services including:

• Maintaining 9-1-1 emergency medical, police/crime prevention & fire response services

• Funding the recently created Local Housing Trust Fund

• Addressing homelessness

• Keeping public areas safe & clean

• Maintaining libraries, parks & recreation programs

• And any other services & infrastructure maintained by the General Fund

"City of Santa Barbara Essential Local Services Measure:

Shall the measure maintaining 9-1-1 emergency/fire/paramedic/police response, keeping neighborhood fire stations open; improving housing affordability; addressing homelessness; keeping public areas/parks safe, clean; maintaining library services, stormwater protection; improving natural disaster preparedness; retaining local businesses/jobs, and for general government use; by establishing a ½ ¢ sales tax providing approximately $15,600,000 annually until ended by voters; requiring audits, public spending disclosure, all funds used locally, be adopted?"

If a customer purchased a taxable item for $1.00, the tax paid would increase by a half-cent from 8.75 cents to 9.25 cents.

The proposed tax increase would be collected in the same manner as the existing City sales and use tax and would be subject to all the same tax exemptions, such as:

- services

- rent

- groceries

- prescription medicine

- utilities

- diapers

- feminine hygiene products

For a complete list of all the sales and use tax exemptions, please visit the California Tax Service Center.

There is a limit on how high sales tax can rise in Santa Barbara: 9.25%

Nearly half of sales tax dollars collected in Santa Barbara come from tourists & visitors from surrounding areas

The City receives just 22% of the current Sales Tax it collects - the rest goes to the State & County

A half-cent sales tax is projected to generate approximately $15.6 Million annually

The Proposed Ballot Measure Ordinance requires an annual audit

If voters approve the proposed tax measure on the November 2024 ballot, the new sales tax rate of 9.25% would take effect on April 1, 2025.

There was a measure enacted by Santa Barbara residents in 2017, Measure C. While Measure C provided funding for some of the City’s aging infrastructure, the City Council has determined that existing City revenues are insufficient to maintain current City services in light of growing demands and rising costs.